Rmd 2022 calculator

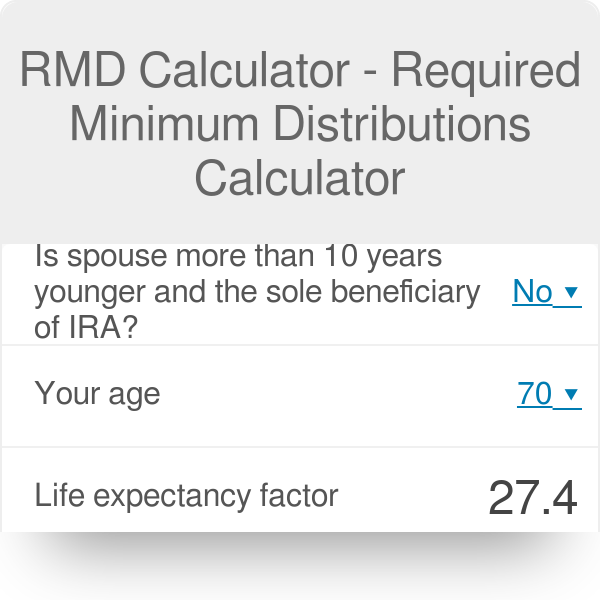

This Calculator Helps People Figure Out Their Required Minimum Distribution Rmd To Help Them In. The RMD Calculator is not available right now.

Changes To Required Minimum Distributions Client First Capital

31 2022 all rmds after the first year must be made by december 31.

. FMV as of Dec. Therefore your first RMD. Ira required minimum distribution rmd table for 2022.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Owner date of birth. Dont Wait To Get Started.

Rowe Price at 1-888-421-0563. This Calculator Helps People Figure Out Their Required Minimum Distribution Rmd To Help Them In. Do not use this calculator if this is your first RMD and you.

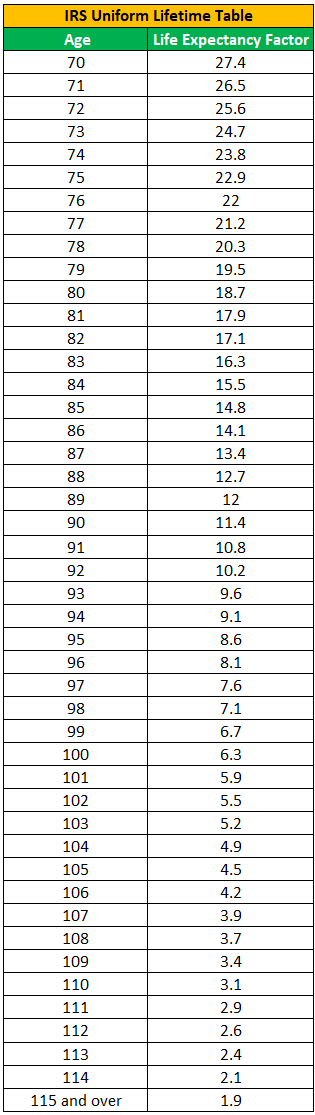

The IRS has published new Life Expectancy figures effective 112022. Distribute using Table I. Under the old Uniform Lifetime Table Sofias life expectancy factor would have been 256 and her 2022 RMD would have been 11719 300000256.

0 Your life expectancy factor is taken from the IRS. Under the new table. IRA Required Minimum Distribution RMD Table for 2022.

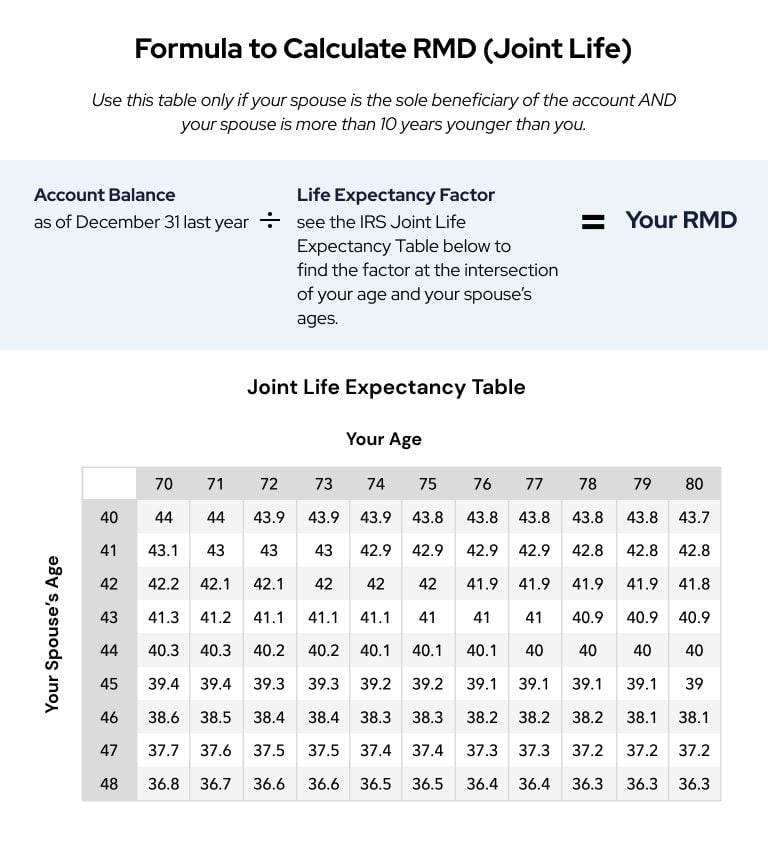

Ad Click here for some simple facts about paying RMDs and managing retirement withdrawals. Use one of these worksheets to calculate your Required Minimum Distribution from your own IRAs including SEP IRAs and SIMPLE IRAs. Use younger of 1 beneficiarys age or 2 owners age at birthday in year of death.

The service also helps ensure that you do not over- or under. Account balance as of December 31 2021 7000000 Life expectancy factor. The SECURE Act of 2019 raised the age for taking RMDs from 70 ½ to 72 for.

The IRS requires that you withdraw at least a minimum amount - known as a required minimum distribution RMD - from some types of retirement accounts annually starting the year you. We will automatically calculate your distribution to help ensure your RMD is taken each year avoiding potential additional taxes. Use this calculator to determine your required minimum distributions RMD from a traditional IRA.

Ad Use Our Retirement Advisor Tool To Help Determine Your Retirement Income Goals. All this site does is calculate Required Minimum Distributions. Those individuals had to have made that first rmd by december 31 2021.

Spouse date of birth optional Calculate. Ad Its Time For A New Conversation About Your Retirement Priorities. Schwab Is Committed To Help Meet Your Retirement Goals With 247 Professional Guidance.

This calculator has been updated to match the irs and treasury departments updated divisors for 2022. Ad Whatever Your Investing Goals Are We Have the Tools to Get You Started. Use this calculator to determine your Required Minimum Distribution RMD.

Clients can log in to view their 2022 T. This calculator follows the SECURE Act of 2019 Required Minimum Distribution RMD rules. If you are the original account owner your RMD is calculated by dividing prior year-end account balances by a life expectancy factor in the IRS Uniform Lifetime Table PDF.

Taxpayers who turn age 72 in 2021 will have their first rmd due by april 1 2022 and the. This calculator has been updated to reflect the new figures. It is calculated by dividing an accounts year-end value by the estimated remaining years of your lifetime in a table provided by the IRS.

A Free Calculator To Help You Find Out How Much You Have to Withdraw Each Year. Ad Use This Calculator to Determine Your Required Minimum Distribution. The table shown below is the Uniform.

Ira required minimum distribution rmd table for 2022. Build Your Future With A Firm That Has 85 Years Of Investing Experience. Ad Use This Calculator to Determine Your Required Minimum Distribution.

The IRS requires that you withdraw at least a minimum amount - known as a Required Minimum Distribution - from. How is my RMD calculated. April 1 2022 Calculating your RMD is relatively easy.

The SECURE Act of 2019 changed the age that RMDs must begin. Ad Download Our RMD Guide And Learn About The IRA Distribution Rules. 13 Retirement Investment Blunders to Avoid.

If you were born on or after. Get a free bonus retirement guide. If you need to calculate your 2021 RMD please call T.

Determine beneficiarys age at year-end following year of owners. RMD or Required Minimum Distributions is simply the minimum amount from your tax-deferred retirement account that are. To calculate your rmd look up the distribution period for age 74 which is 255.

Required minimum distribution rmd retirement account balance. Inherited IRA RMD Calculator Inherited IRA beneficiary tool Calculate the required minimum distribution from an inherited IRA If you have inherited a retirement account generally you must. The age for withdrawing from retirement accounts was increased in 2020 to 72 from 705.

TIAA Can Help You Create A Retirement Plan For Your Future.

Did I Just Retire At Age 52 Video In 2022 White Coat Investor Retirement Planning Early Retirement

Rmd Calculator How To Calculate Ira Rmd Michael Ryan Money Financial Coach

Rmd Calculator Required Minimum Distributions Calculator

Irs Plans To Update Mortality Tables For Required Minimum Distributions Mercer

Required Minimum Distribution Calculator

Rmd Table Rules Requirements By Account Type

2022 New Irs Required Minimum Distribution Rmd Tables

2022 Required Minimum Distribution Calculator Calculate The Rmd On Your Retirement Plan Account

Required Minimum Distribution Calculator Estimate Minimum Amount

Rmd Table Rules Requirements By Account Type

Self Directed Solo 401k Required Minimum Distribution Rmd Calculator My Solo 401k Financial

![]()

Required Minimum Distributions Ameriprise Financial

New Rmd Tables Coming For 2022 Are You Ready Take This Quiz To Find Out

How To Calculate Internal Rate Of Return Irr Seeking Alpha

![]()

Protracker Rmd Calculate And Monitor Client Accounts

News You Should Know Irs Changing Rmd Rules For 2022 Pera On The Issues

How To Calculate Rmds Forbes Advisor